AKSH OPTIFIBRE LIMITED

Company Overview:-

- Aksh Optifibre Ltd is more than 3 decade old company having expertise in manufacturing of Optical fibre, Optical Fibre Cables, and FRP rods. It was founded in 1986.

- The two key raw materials, optical fibre and FRP rod, constituting 70% of cost of optical fibre cables are manufactured in-house. This makes Aksh as one of the most cost effective optical fibre cable manufacturer. Also, Aksh is now the largest FRP rod producer, supplying to all optical fibre cable manufacturers in 56 countries across six continents.

- Aksh Optifibre Limited has been awarded "Turnkey Liveline Installation of 2600 Km of All Dielectric Self Supporting (ADSS) optical fibre cable by Bhutan Power Corporation Limited(BPCL). ADSS Project Phase I for connecting all District headquarters & 131 Gewogs (Group of Villages) is completed.

- On this successful completion, Government of Bhutan awarded Package II (ADSS project Phase II) in 2012 under National Broadband Master Plan to connect remaining 74 Gewogs of Bhutan to achieve the 100% connectivity to all parts of the country. This project will be completed by March 2014.

Industry Structure & Growth:-

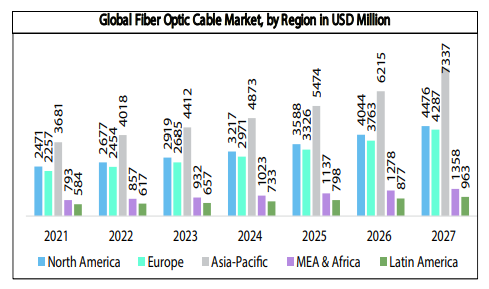

- Fiber Optic Cable Market is expected to grow at CAGR of 10.37% during the period 2020-2027 and is expected to reach USD 18421 Mn. by 2027.

- As Telecom operators are very aggressive for deployment of 5G networks, and increasing demand for Digital connectivity to masses, Industries, Rural and Urban areas, the growth may be higher, in this segment.

- Internet Of Things, Big data, Cloud computing and almost every thing is shifting to digital, over the cloud, and that demands a robust broadband connectivity, data transfer infrastructure, etc.

- Indian Govt push on Digital India, Smart cities, Broadband connectivity to rural areas, and increasing demand of FTTH(Fibre to the Home), Increasing need of Data centres, etc are major driver of Growth domestically.

- Global Fiber Optic Cable Market:

- Fiber optic technology is evolving in tandem with the rising need for better speed and efficiency. New equipment, such as optical couplers and optical switches, are enabling the All-Optical Networks (AON) trend.

- San Francisco has committed to building a city-wide fiber-optic network, making it the first large city in America to do so. This initiative, if completed successfully is expected to be a significant step toward internet paradise.

- Another network operator plans to lay 8,000 miles of subterranean underwater fiber optic cable from Los Angeles to Hong Kong to meet the rising demand for Facebook and Google.

- Facebook has announced proposals to develop 2Africa with a partnership of China Mobile International, MTN GlobalConnect,

- Orange, STC, Telecom Egypt, Vodafone, and WIOCC. The 37,000-kilometer underwater cable system, one of the world’s longest, will connect 23 nations across.

- India Fiber Optic Cable Market:

- To meet the rising demand for high-speed data transmission, the goal of Indian Government is to have optical fiber installed in all 600,000 Indian villages, including those in rural places by 2025.

- The government has put aside a total of 19,041 Crores for viability gap financing.

- The country’s first underwater optical fiber network was opened as part of a new initiative for the Andaman and Nicobar Islands by Prime Minister Narendra Modi.

- Amazon is investing $2.8 billion in India to build data center infrastructure.

- Railways will lay down about 7000 Rkm of OFC to eventually cover the entire railway network across the country.

- Future Outlook:-

- Global fibre optic demand seems to be robust for next five years. Maximum growth is supposed to come from North America and Asia Pacific region.

- India Fiber Optic Cable Market was worth US$ 881 Mn. in 2020 and the total revenue is expected to grow at a CAGR of 11.24 % from 2021 to 2027, reaching nearly US$ 1857 Bn. by 2027.

Business Verticals:-

- Aksh Fibres mainly Provides Optical Fibre Cable, Optical Fibre, Fiberglass reinforced plastic rod(FRP Rods), They also provides FTTH Solutions.

- They manufacture a range of Optical Fibre Cables that include Single Mode & Multimode Cables, Duct Cables, Armoured, FTTH (Aerial installations & fibre to home) Cables, Indoor & Outdoor Cables and Special application cables (Hybrid, All purpose, Ceramic Armoured cables)

- Fiberglass reinforced plastic rod:-

- FRP Rod (Fiberglass reinforced plastic rod) being one of the critical components of OFC (Optical Fibre Cables), it’s demand is proportional to Optical Fibre consumption in Telecom industry. FRP Rod is applied as a central strength member as well as embedded in the sheath.

- With capacity to produce one million Kilometre Glass and Aramid fibre reinforced plastic rods (FRP Rods), Aksh is now the largest producer in the world.

- Aksh also has capacity to produce 3000 Metric tonne of Water blocking and PU coated Glass fibre.

- FRP rods are used as strength member in almost all types of Di-electric OFC including various type of cables for last mile connectivity. The demand for FRP rod was mainly driven by regions like North America, APAC and emerging economies.

- Optical Fibre Cables :-

- AKSH's state-of-the-art optical fibre and optical fibre cable plants are located in Rajasthan. With over 27 years experience of manufacturing optical fibres, AKSH is able to offer an extensive product portfolio made to achieve the highest levels of quality and performance.

- Energy Efficient Products:-

- Aksh has launched 9W LED bulbs, 1000 Lumens with 3 yr Warranty.

- AKSH holds a reputation of being the pioneer in manufacturing of raw materials for optical fibre cables and is globally renowned for high quality FRP (Fibre reinforced plastic) Rods , ARP (Aramid reinforced plastic) rods and WS yarn (water blocking yarn) that gives the best reinforcement and strength to Optical Fibre Cables.

- In 2002, AKSH started its 1st Fibre to the Home (FTTH) in Jaipur and later collaborated with MTNL & BSNL in Jan 2010 to launch its 1st FTTH project in Jaipur. Similar projects are started in Delhi and Mumbai in collaboration with MTNL and in Ajmer, Faridabad and Gurgaon in collaboration with BSNL.

Key Drivers of Growth:-

- The FRP rod demand in India is likely to be on growing path considering ongoing ambitious government plan of connecting rural parts of India, specifically, the increasing last mile cables requirements i.e. FTTH cables is driving the demand up in the coming futureAksh acquired Telecords (I) Pvt. Ltd. for the manufacturing of Fibre Reinforced Plastic (FRP) rods, as a backward integration and reduction of costs.

- With the ongoing project Bharat Net which is one of the largest broadband project globally undertaken by the Government of India and aims to connect 2.5 lakhs gram panchayats with optical fibre.

- Government of India is planning and doing POC from FTTH in Village Panchayats and Village level so there is huge opportunity to work as system integrator for complete OFC network solution with O&M.

- FTTH and 5G network roll out expanding across India so there is possible space to get execution contract including supply.

- Smart sensor based solution of Parking, lighting, agriculture, water flow, Level status are coming and we are confident to get the business in this stream as pioneer in complete sewerage level flow sensors deployment in India.

Risk & Uncertainities:-

- Retained Earnings/Cash reserve:- There is a net deficit of Rs. 14,970.04 lakhs in the Retained Earnings as at March 31, 2022, as compared to net deficit of Rs 16,724.62 lakhs as at March 31, 2021.

- In Annual report disclosure, The company says:- "Consequent to the cash crunch faced by the company resulting into bank defaults, Company has submitted Restructuring proposal to the consortium of lenders which is under their consideration."

- The Auditor has Given an unqualified Opinion, (A qualified opinion is a reflection of the auditor's inability to give an unqualified, or clean, audit opinion)

- The auditor has given following basis for unqualified opinion:-

- The Subsidiary Company namely AOL Technologies FZE, Dubai has Capital work in progress as on 31st March 2022 amounting to Rs. 9,294.38 lakhs in respect of Optical Fibre Manufacturing Plant. Presently the project has been suspended due to paucity of funds and no impairment testing has been carried out by the management of Subsidiary Company.

- The Subsidiary Company namely AOL FZE, Dubai has been incurring losses from last few years, resulting in erosion of net worth. The Company is also in default with the Banks towards repayment of its borrowing obligation. Aksh have not done Impairment testing, to realize current value of assets, so, it can't be said that to which extent it would impact financial statements.

- This situation emerged because of consistent losses over past 3 yrs, from FY20 till today only 2 Quarters, March and June for current fiscal was profitable,

- The company has current outstanding debt of around 180 Cr, Debt to Equity ratio stands at 1.99 which may arise in future if profitability and cash flow does not improves quickly.

- All subsidiaries are making losses, although likely to recover in coming years.

Frauds or Corporate Governance Issues:-

- One serious fraud has happened in 2010 for which SEBI vide its Order dated 28 February, 2020 levied penalty of Rs. 1,000 lakhs u/s 15HA and Rs. 15 lakhs u/s 23E of Securities Contracts Regulation Act (SCRA), 1956 for alleged irregularities in the issuance of GDRs allotted by the Company in the year 2010.

- Another Fraud has taken place during past several years:- 600 Cr Fraud - Link - An independent director of a Delhi-based maker of optic fibres has written to the board and the finance ministry accusing its promoters of siphoning off at least Rs 600 crore through multiple related party transactions, faking investments in a byzantine collection of shell companies, over-invoicing overseas purchases and fudging company accounts over several years.

- The company is having disputes with income tax, Goods & Service Tax, service tax, duty of customs, duty of excise which have not been deposited, and those amounts equals to 380 Lakhs.

- The company has defaulted over dozen of Loans issued by various banks in past several years, Although it is not said to be a defaulter by Independent Audit committee-

Financials:-

- Consolidated Profit & Loss Statement- Revenues were growing till 2018, but it has shown a considerable decline and then being stagnate since past 2 yrs. Profitability consistently deteriorating since 2017, but in past few quarters it has shown a hope of some positive numbers in coming Fiscal.

- Consolidated Balance Sheet- Asset is consistently decreasing since 2019, although Debt is reduce by some percentage, still a considerable amount of debt on book as compared to total asset.

Shareholding pattern :-

- Around 62% of shares are held by public, and 27.95% is held by promoter. Promoters have released all pledged shares this September.

Valuations :-

- Current Market price as of 16 Dec. Closing was 10.4 Rupees, with Total Market Cap of 168 Cr. Some considerable appreciation is expected in coming few qtrs.

- P/E ratio is 241, TTM basis, P/S ratio is 0.55, P/B is 1.6 - These parameters shows the company is still undervalued.

- Considering all the past frauds, Risk and Uncertainty with Management/Promoters, Past few years losses It is not a very high opportunistic company but the very high Rising demand and Market Size of 5G Networks, Data cables, etc, Betting on this company can be Rewarding too.

- Overall, Allocating some amount of funds and adding more as it rises will be little better strategy.

- We should use some diversification to catch this big uptrend in this sector, by allocating funds to few more company like this, Example- HFCL, VINDHYA TELELINKS, STERLITE TECH, TEJAS NETWORKS, etc. In this way we can reduce the risk and grab rewards.

<END>

No comments:

Post a Comment