DreamFolks Services Ltd

India and APAC Aviation Sector:-

- The growing markets within India and South Asia are some of the key drivers for the growth of the overall Asian aviation sector. South Asia is forecasted to have a passenger growth rate of 6.9% till the year 2040.

- India’s economy is anticipated to grow with a CAGR of 5.1% between 2021-2040. The demographic factors and the high propensity to travel within India is expected to accelerate the growth associated with the Indian aviation market.

INDIAN AIR TRAVEL MARKET OVERVIEW :-

- Air and Rail Travel Propensity

- Amongst the least air travel propensity countries, India is the lowest, however, it is also expected to be the third largest air travel market by 2030 according to IATA (International Air Transport Association).

- India’s Air Traffic Growth Trend

- Overall, the average historic global growth rate pre covid for passengers transported is recorded to be 4.86% (2015- 2019) while India’s is 11.12% for the same period.

- The following are the factors which are expected to contribute to the overall Indian Air Travel growth:

- Jump in India’s Travel and Tourism Competitiveness

- Jump in Ease of Doing business

- Growth in Business Travel

- Reducing Cost of Air Travel

- Increased travel in Tier-2 and Tier-3 destinations

- Jump in India’s Travel and Tourism Competitiveness

2. Jump in Ease of Doing business

The Ease of doing Business Index released by World Bank suggests the competitiveness and penetration of a market based on various strategic parameters. The ease of doing business in India score has been increasing, and India moved from a rank of 142 in 2014 to 63 in 2019.

3. Business Travel Market Size and Growth

Between 2016-2020, Delhi and Mumbai are seen to account for the largest share in terms of domestic and international travel Thailand ranks as the first country, with around 80% of Thai business travellers extending their trip for leisure.

4. Reducing Cost of Air Travel

5. Air Travel Growth in Indian Cities - Tier 1, Tier 2 and Tier 3

The Tier 1 cities contributed to around 85% of the total air traffic in FY 2016-17, however in FY 2020-21 it reduced to 81%. The Government initiatives like UDAN combined with airport infrastructure development in Tier 2 and Tier 3 cities are expected to increase the percentage of air traffic from such smaller airports.

- The Indian market is expected to grow at almost 6X from around 175 million air travellers in 2019 to around 1 billion travellers in 2040 as compared to the expected global growth of 2X to a total of 10 billion passengers in 2040.

- The Indian aircraft fleet is also expected to grow 3X and reach around 2200 aircraft by 2040.

- The Indian growth scenario is supported by various factors such as government initiatives, infrastructure improvement, increase in demographic dividend, increase in per capita income and the GDP growth as discussed in earlier sections of the report.

- The average split across the Domestic and International Air Travel Industry for India was recorded to be between 84%-85% and 16%-15% in CY 2018 and CY 2019. This proportion changed to >90%, in favor of Domestic traffic due to international travel regulations due to COVID.

- The Indian aviation sector is expected to make a recovery to pre-pandemic values by the year 2022. The CAGR for the current and upcoming scenario (post pandemic) is expected to be 15% (Domestic) and 12.04% (International) for the period 2020-2040.

- The Indian domestic air travel passenger is expected to grow at a CAGR of around 39% and surpass 260 million in 2025. The international Indian air travel market is expected to almost grow at 122% CAGR in 2025, compared to 2021 market.

The rise in passenger growth will be supported by an increase in the number of airports, fleet and infrastructure as below:• The total number of operational airports is expected to reach 295 by 2040; these are a combination of second airport within the same city and new Greenfield projects.• The initial regulations that hindered the development of second airport within the same city has been removed. Navi Mumbai airports and similar projects are key growth drivers for DreamFolks• As of 2018, there were around 7 airports that handled more than 10 million passengers, this is expected to nearly 7X and reach 47 by 2040. This is expected to be a key opportunity with the possibilities of multiple lounge options at these airports.

- The number of Lounges will increase from 50 today to 70-90 in 2025, 150-160 in 2030, to around 190 in 2040.

- Greenfield airports contribute significantly to economic growth. The government of India has agreed in principal for the development of 21 Greenfield airports in the coming 4-5 years.

- The overall program cost is estimated to be Rs 25,000 crores. As of 2020, there were roughly 125 operational airports in India, and it is expected to increase to 295 operational airports by 2040. The Indian Government plans to spend around INR 1 trillion to set up new airports by 2024 .

Key Initiatives-5 Year Plan• An investment of INR 350,000 million (USD 4.99 billion) is to be made in the next 4 years by the Indian government to support the aviation sector.• The Indian Government has planned on investing roughly USD 1.83 billion by 2026 for the development of airport infrastructure.• The government also plans on upgrading the airport navigation system.• A major asset monetizing exercise has also been undertaken by the Indian government, i.e. the privatization of 13 airports.• The government has been aiming for private investment of Rs 3,660 crore in airports by FY24.• Presently, the AAI has approved the privatization of 6 major airports which including, Bhubaneshwar, Varanasi, Amritsar, Trichy, Indore, and Raipur.• The upgradations for these airports are expected to enhance the customer experience. Therefore, the privatization of airports can be viewed as a key opportunity for lounger operators in terms of exploring new markets.

UDAN Scheme

- UDAN (Ude Desh ka Aam Naagrik) aims to link underserved and unserved airports in the country. The Regional Connectivity Scheme (RCS) aims to increase inter-regional connectivity by connecting 70 airports through 128 routes operated by five airlines. According to the latest findings, of 70 airports, 31 are unserved and 12 are underserved.

- A total of 128 routes will be operated by five airlines, including SpiceJet and an Air India subsidiary, Airline Allied Services. During the commencement of the scheme, Airline Allied Services and SpiceJet operated 15 and 11 routes respectively.

- There were 50 routes under Air Odisha Aviation's banner, followed by 34 under Air Deccan, and 18 under Turbo Megha Airways. Each carrier flies aircraft with a seating capacity of 19-78. The Ministry of Civil Aviation has approved 780 new air routes as part of the UDAN scheme for regional air connectivity.

- UDAN 3.0 was the defining principle behind Indigo airlines' maiden flight from Agra to Lucknow in 2021.

- As of today, 371 routes and 60 airports (including 2 water aerodromes and 5 heliports) have been operationalized by the scheme. Additionally, additional flights will also be offered from Kanpur and Lucknow soon.

- The Civil Aviation Ministry's agenda over the next year includes the construction of the Kushinagar airport and the Jewar airport in Uttar Pradesh. It will aid in launching 50 new routes under the UDAN scheme.

- Other airports under the scheme are Deoghar in Jharkhand, Gondia and Sindhudurg in Maharashtra and Keshod in Gujarat. Several heliports including Sanjoli, Mandi Baddi and Sase in Himachal Pradesh will operate soon. The heliports in Haldwani and Almora in Uttarakhand will soon be operational.

- In FY 2019 and FY 2020, 102 and 120 RCS routes started operation, respectively. As a result of the COVID-19 pandemic, there were 77 new routes in FY2021. In addition, the amount incurred by the central government in FY2018 - FY2021 was Rs 3,350 crore, and the amount planned for FY2022 is Rs 1,130 crore.

- Non- Aeronautical Earnings per Passenger

- The non-aeronautical earnings per Passenger was at INR 75.94 in 2016-2017 and has risen by more than 300% to INR 250.56 in 2019-2020. The reduction in value of 2019-2020 from 2018-2019 is attributed to reduction in international and domestic passenger in the early phase of COVID 19.

- The development of retail spaces, lounges, restaurants and other facilities have contributed to the growth in earnings per passenger. As air travel resumes and there is a growth in the both the number of passengers and per-capita income, the non-aeronautical revenue is expected to resume its upward trajectory.

- The share of Non- Aeronautical revenues for private airports like Delhi, Mumbai and Bengaluru varied between 50%- 70% of their overall revenue in FY 2019. However, the non- aeronautical revenues from AAI managed airports were around 10%-15% for FY 2019. This is an indicator of how passengers are willing to spend more if provided with better services, and will benefit the lounge market among other retail spends by passengers.

- Overall Airport Services Market Size

- The overall airport services revenue has been shown in the Figure below. The airport services registered a high growth from INR 1304.97 crores in 2016-2017 to INR 1842.5 crores in 2018-2019. The increase in 2019-2020 was marginal at 1887.74 crores due drop in traffic in the last quarter due to the early effect of pandemic.

- Currently, six airports are operated under the PPP model namely Mumbai, Delhi, Bengaluru, Cochin, Nagpur and Hyderabad. A PPP model is proposed for six more airports in Jaipur, Lucknow, Ahmedabad, Guwahati, Mangalore and Thiruvananthapuram.

CARD INDUSTRY (CREDIT AND DEBIT)- INDIA

- The credit card industry in India is experiencing high growth. The credit card market grew from around 33 million outstanding cards in Sept 2017 to around 65 million outstanding cards in Sept 2021 at a CAGR of 18.17%.

- Similarly, there were around 819 million outstanding debit cards in Sept 2017 which grew to 920 million debit cards in Sept 2021 growing at a CAGR of 2.93%. Outstanding debit cards is expected to surpass 1 billion next 2-3 years.

Card Market Size CY 2015-CY 2021

- The credit card market grew at around 21.57% and debit card market grew at around 6.61% CAGR between the years (CY) 2015 to 2020.

- There were around 22 million credit card users in 2015 and this increased to around 60 million in 2020.

- It is expected that the number of credit card users in 2021 would surpass 68 million.

- HDFC Bank has the largest market share with a value of 23% in 2021 (Sep 2021).

- State Bank of India acquired the second largest market share with a value of 19%.

- Debit Card Market Share CY 2020

- The CAGR for growth in credit cards issued between the years 2021-2040 is expected to be at around 20%. The key inputs for the modelling includes Demographics, Employment, Historical Growth, Rate of Digital penetration, GDP and increased PPP.

- The number of credit cards issued is anticipated to reach 2.2 billion by 2040. From card networks and card issuer’s perspective, providing Customers access to the value added services, including lounges, is increasingly becoming a key aspect of their credit / debit card service offering for customer engagement and customer loyalty.

- According to market projections, the CAGR for debit cards issued registered a value of 7% between CY 2021- 2040. The key inputs for the Demographics, Employment, Historical Growth, Rate of Digital penetration, GDP and increased PPP.

- The number of debit cards issued is expected to reach 3.5 billion by the year 2040.

- Number of Cards with Lounge Access

- The current credit and debit cards with lounge access in India is estimated at around 57.20 million (CY 2021). Out of this around 4.7- 5 million passengers use Debit / Credit card for lounge access. Therefore, the percentage of passengers using credit and debit card for lounge access is around 8% which is expected to increase due to higher awareness and other drivers in this market.

- The total domestic and international lounge access is estimated at around 7.5 million passengers per annum (Pre COVID) FY 2020, using all method of access. The FY 2018 and FY 2019 numbers are estimated to be around 5.1 million (FY 2018) and 6.3 million (FY 2019)

- The credit card and debit card based lounge access feature card holders are expected to grow from 57.20 million in 2021 to 511.86 million in 2040.

GLOBAL AND INDIAN LOUNGE MARKET OVERVIEW

- The airport lounges have grown steadily in India over the past 5 years. The growth was being driven by the metro cities until about 2-3 years ago, however in the past 2 years the lounges have been expanding in non- metro airports as well. Any airport with a passenger movement of around 5-6 million a year can accommodate a successful lounge.

- The number of lounges in an airport is proportional to the passenger numbers; the top 24 Global Airports average at around 7 lounges per airport.

- The Indian Airports average at around 2 lounges per airport. The Indian lounge market is expected to grow at 4X times of the current market size and is expected to reach 193 lounges by 2040.

- Total Number of Global Lounges VS Indian Lounges

- Guangzhou International (19 airport lounges) stationed in China is seen to have the largest number of airport lounges followed by Xian Xianyang International (12 lounges).

- On an average, top 25 international airports have roughly 7 lounges per airport.

- Total Number of Indian Airport Lounges

- Indira Gandhi International Airport stationed in New Delhi has 7 lounges which are recorded to be the highest, followed by Chatrapati Shivaji International in Mumbai (6 airport lounges).

- On an average, top 25 airport have only 2 lounges per airport.

- Airport Lounge Product Lifecycle Stage – Key Countries

- In terms of global standards, India is seen to be towards the introductory stage of the product life cycle.

- Markets like the US, UK, France, Brazil, UAE, and Mauritius are in the growth stage of the product life cycle owing to the economic status and high passenger traffic in these nations.

- US and UK have the highest passenger volume amongst nations in the Growth stage of the product life cycle with a value of 926 million and 143 million respectively.

- Markets including Thailand, Vietnam, and Germany are in the Mature stage of the product life cycle.

- The economic modelling has been based on selected countries across the region, the potential markets for DreamFolks in Asia are Thailand and Vietnam. Similarly, UAE is a potential market for DreamFolks in the Middle East region. Mauritius is a potential market for DreamFolks in the African continent.

- Projection for No of Lounges in India

- The no of lounges are expected to grow at an average 10% YoY between the period 2021-2040.

- As of 2021, the number of airport lounges in India is recorded to be 50, and this is expected to grow to around 193 lounges in the next two decades.

- An increase in passenger traffic and growth in demand within the air travel industry is expected to boost the market growth.

- The introduction of projects like UDAN and the ongoing construction for 100 greenfield airports in India48 (construction to be completed in 10-15 years) is expected to increase the potential opportunity for airport lounge operators within this market.

- Increased privatization of airlines is also expected to increase the investment for airline-based lounges. The growth in the lounge operators market is anticipated to increase opportunities for the lounge aggregators market as well.

- The average airport lounge size was around 2100 sq. feet in 2014, this increased more than 5X and reached around 11,000 sq. feet in 2019. The space availability at airports are a key challenge for the expansion of lounge area in airports.

- In case of Greenfield airports the availability of space for lounge operations is easier. The increase in lounge space proves that the market is in the positive trend.

- The three key metro airports namely, New Delhi, Chennai and Mumbai account to around 35% of the lounges in India. DreamFolks has access to all the 50 lounges in India.

- Key Lounge Operators in India

- The airport lounge market in India has numerous players, currently there are 50 lounges in India. Premium Port lounges has 11 lounges placed in Delhi, Hyderabad, and Chandigarh. Travel Food Services Private Limited has around 12 lounges across India.

- Number of Lounges per Operator

- The share of lounge providers in India shows that Travel Food Services Private Limited lounges have the highest market share of 24%, followed by Premium Port Lounge Management Company with 22 % of the domestic market share. The third largest player is Saptagiri Restaurant Private Limited.

- DreamFolks has tie up all lounge operators including the market leaders viz. Premium Plaza Lounge and Travel Club Lounge. The lounges work in close coordination with DreamFolks as it provides more than 80% of the overall traffic for most lounges, and also reduce the need for lounges to tie up with multiple bank / other partners.

- DreamFolks cover 100% of lounges being operated in India, while it has significant exclusivity for India issued credit and debit card programs in key locations.

Airport Lounge Market in India

- The key drivers, and restraints that are expected to impact the Airport Lounges Market in India are enumerated in succeeding paragraphs.

Drivers

- Growing Air Traffic and Passenger Traffic: Passenger traffic has been growing steadily since the new millennium, driven largely by income growth and low-cost aviation.

- The Domestic air travel increased from 80.75 million in CY 2015 to 143.74 million in CY 2019. It is projected that India will overtake the UK to become the third-largest air passenger market in 2024.

- Furthermore, India is one of the world's fastest-growing domestic aviation markets.50. The international passengers have also grown from around 18.42 million in CY 2015 to around 14.29 million in CY 2019. Hence, with growing air and passenger traffic, lounge market would flourish.

- Development of New Airports: India will require 2,380 new commercial aircraft by 2040 because of an increase in air travel. A total of 200 new airports will open in India by 2024.

- It is estimated that India will have 295 airports by 2040, and the increase in airports will drive the lounge market.

- Additionally, Tier 2 and Tier 3 are likely to have a lower penetration of services. Which is likely to drive the lounge markets especially for providers who offer value for money.

- Government Initiatives: The government of India has launched many schemes to make flying affordable for people of all income levels.

- Under UDAN 4.0, 24 routes were identified in Assam in February 2021. During the UDAN 4.1 bidding process, the Ministry of Civil Aviation (MoCA) has proposed 392 routes as part of the Azadi Ka Amrit Mahotsav launch by the Government of India in March 2021.

- The UDAN scheme and the privatization of the airports are expected to the key government initiatives which could contribute to this market.

- Increasing Uptake of Digital Economy: The current credit card penetration is extremely low in India, it is around 3% for credit cards as shown in the figure below. The penetration of digital economy and cards is expected to increase exponentially due the effect of pandemic, large customer base, rising income, and changing attitude of the end customer.

- In turn, the financial system will have a greater incentive to manage customer loyalty; programs like lounge access will form a significant part of the loyalty management initiative.

- LCC Market Share in India: The low cost carriers have a significant market share in India, and this is expected to continue in the foreseeable future. The LCC carriers need to keep the upcoming competition from full service carriers like Vistara and Air India (taken over by Tata). To manage customer loyalty, offering lounge access as an add-on will be a good option for these airlines.

- Business Travel, Tourism, and Customer Experience: India has been seeing a steady increase in business index and tourism. Both factors will play a major part in driving the lounge market especially when the Indian airports rank much lower than the global airports in overall customer experience. Lounges will be key beneficiary as they offer an enhanced customer experience. will be one of the key features Involvement of banks

- Addition of Lounges: On an average it can be stated that the top 25 airports in India account to 2 lounges per airport. This is much lesser than the Global average which is 7 airports per top 25 Global airports. The number of airport lounges in India is very small. Currently, there are approximately 50 lounges in India, and the overall number of lounges will increase in line with increasing traffic and passengers.

- It is important to note that the overall growth in lounge also includes the growth in lounge area in the existing lounges which are not included in the 143 new lounges which are expected to be added in between the years 2021-2040. The total number of lounges are expected to be 193 by 2040, these include the additional lounges across existing airports and new lounges across Greenfield airports.

- High rentals - High rental has always posed a challenge for lounge providers. Recently, airport hospitality providers have asked airport operators to reduce the high rental prices they pay for using their facilities. The lounge operators at some airports pay a minimum guaranteed amount. These operators have asked to reconsider the amount. Plaza Premium Group and Bird Group and Travel Food Services (TFS) are the two major lounge operators in the country, and together they operate about two dozen lounges across airports.

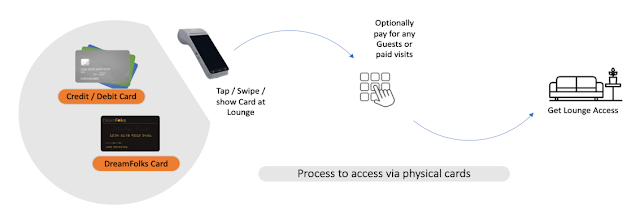

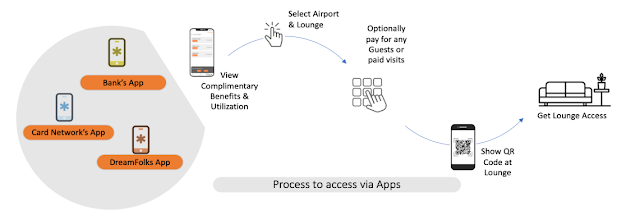

Customer Access Methods to the loungesThe customers can access Airport Lounge through the following methods:- Credit Card/ Debit Card- Airline Business Class / Airline Frequent Flyer Programs- Lounge Membership Cards, Digital Access, and QR Codes- Other Voucher, Digital Apps and QR codes- Walk-In

LOUNGE ACCESS AGGREGATORS MARKET IN INDIA

(DreamFolks, Priority Pass (Collinson), Dragon Pass, Others)

DreamFolks

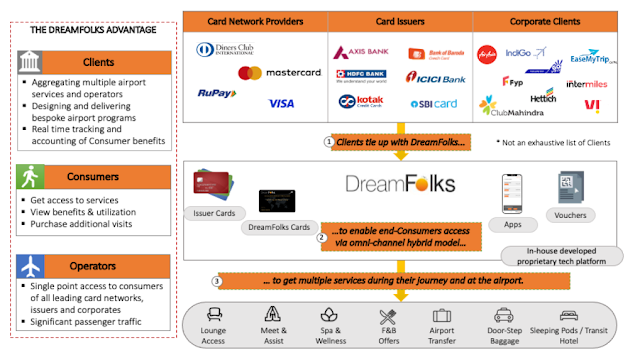

- The main business model of DreamFolks is to act as a service provider between the lounge operators on one side, and banks, card networks, airlines and corporates on the other end.

- DreamFolks is a dominant player that has 100% lounge coverage in India with significant exclusivity for India issued credit and debit card programs in key locations.

- DreamFolks also leverages technology and offers the solution through omni channels such as App based access, tracking live benefits on each cards.

- The technology driven solutions of DreamFolks is one of the key elements that enables its clients to provide value added services to their end customers as a part of their customer engagement and loyalty management programs

- Additionally the company is also diversifying into overall airport experience by offering services such as Meet and Assist, Nap Rooms, Food and Beverages, Airport Transfers, Spa, Door-step Baggage Services, etc.

Priority Pass

- Priority Pass is a U.K-based company that was founded in 1992. The program is owned by Collinson Group. The program includes access to lounges for passenger across both, the economy class and premium class.

- There are three levels of membership available on the company's website: Standard, Standard Plus, and Prestige. A customised option is also available for partner banks.

- Currently, the company offers access to more than 1300 lounges worldwide. Priority Pass offers discounts on dining, retail, and spa services through the Priority Pass app.

DragonPass

- Dragon Pass company was founded in 2005 in China. Since the company was originally an airport lounge provider, it has developed services and solutions across the entire airport experience.

- The company boasts a network of more than 1300 airport lounges around the world. It offers a variety of services, from airport restaurants and spas to limousines, as well as meet and greets.

- Over the years, the company has refined its digital platform, offering its members a comprehensive range of full services accessible from one app

- Lounge Key is an airport lounge benefit program that covers roughly 500 premium airport lounges across 300 cities. The airport lounge aggregator provides access to roughly 750 lounges worldwide and .38 lounges (across 20 airports) in India.

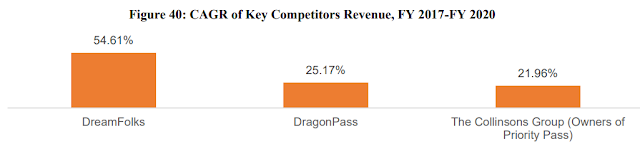

- The CAGR of DreamFolks is around 55%, which is much higher than its closest competitor. The first mover advantage coupled with their service model has enabled DreamFolks to become a dominant player in the industry with a share of over 80% in the Domestic lounge access market in India.

Banking Partnerships

- DreamFolks covers most of the banks in India, it covers India’s largest private and public sector card issuing companies such as HDFC Bank Limited, SBI Cards and Payment Services Limited and ICICI Bank Limited.

- This strong network is expected to support their entry into the international market.

- DreamFolks accounts for almost 95%-97% of the India issued debit and credit card based access to the lounges for FY 2020. The company has been successful in building the bridge between the lounge operators and the debit or credit card issuers.

- It is also important to note that out of an estimated 7.5 million passengers using lounges in India more than 80% (Domestic Lounge) use India issued credit and debit card method to access the lounges.

- However, the access to international lounges is also facilitated through foreign cards, other loyalty cards and Airline based access.

- DreamFolks has coverage across 50 lounges constituting 100% of India’s Airport lounges across domestic and international airport terminals.

- DreamFolks also services India’s sector leading corporates viz., airline companies such as Indigo, GoFirst and Air Asia, telecommunication service providers such as Vodafone Idea Limited, and clients such as Easy Trip Planner Limited and Mahindra Holidays.

MARKET SHARE BY VOLUME OF PASSENGERS

- DreamFolks constitutes to around 67% in FY 2020 of the overall lounge traffic in volume across all lounges in Indian airport, this includes both the domestic and international lounges.

MARKET SIZING AND FORECAST OF THE AIRPORT LOUNGE ACCESS AGGREGATOR MARKET IN INDIA

- DreamFolks is India’s largest airport service aggregator platform facilitating enhanced airport experience to passengers and accounts for around 67% of the overall lounge access volume in India (Domestic and International).

- The total number of lounge users are estimated at around 7.5 million passengers in FY 2020 for Domestic and International lounges.

- Out of this around 80% of domestic passengers prefer usage of India issued credit / debit cards to gain access to the India domestic lounges.

- DreamFolks accounts to around 95%- 97% of the market to access lounges through India issued credit / debit cards for Domestic Lounges.

- It is important for the lounges to continue giving access to debit and credit card users to ensure higher lounge utilization.

Indian Lounge Access Aggregator Market Forecast FY 2021- FY 2030 (In Volume (Passenger (Pax) Million))

- Credit card based lounge access accounts for 80% for India Domestic lounges and around 40% for India International Departure lounges.63. DreamFolks accounts to almost 95%-97% of this India issued credit and debit card segment. The tie-up with all of the aforementioned card networks enable almost 95%-97% of all transactions undertaken by Customers in airport lounges on the Dreamfolks platform for this segment.

- From 7.5 million FY 20, the market dipped in FY 2021 due to COVID and is currently showing signs of a quick recovery. The lounge market is expected to reach 70 million passengers in FY 2030 at a combined CAGR of 41.78%.

Indian Lounge Access Aggregator Market Size & Forecast FY 2021- FY 2030 (In Value (INR Million))

- The overall Indian lounge market which includes passengers accessing both Domestic and International lounges is estimated at around INR 8,175 million (FY 2020).

- There was a dip in FY 2021 values due to COVID, as compared to FY 2020. In the current financial year, the market is estimated at around INR 3,589 million, which includes both domestic and international lounges across all Indian airports.

- This is expected to grow to INR 58,619 million by FY 2030 at a CAGR of 43.11%. Around 80% of the lounge traffic in Indian domestic lounge is through India issued credit and debit cards and DreamFolks dominates almost 95%-97% of this market.

NOW WE WILL KNOW ABOUT DREAMFOLKS

- DreamFolks Services Ltd is India's largest airport service aggregator platform facilitating an enhanced airport experience to passengers leveraging a technology-driven platform.

- They operate on a very asset light business model, and does not own any lounges.

- Liberatha Peter Kallat, Founder & MD, DreamFolks Services Pvt Ltd.

Liberatha Peter Kallat, has significant experience in the hospitality industry and she has worked with Indian and global multinational companies such as Indian Hotels Company Limited. She has over 3Years of experience of Plaza Premium Group, a UK Based Airport lounge operator.

Liberatha has been instrumental in envisioning the business opportunities and growth potential of the industry. She has been at the forefront of incubating the industry which has led to our first mover advantage. This first mover advantage along with our business model is one of the key reasons for our dominance in the industry. Liberatha’s deep understanding of the industry and her direct involvement with key Clients and Operators forms the bed-rock of our business relationships.

- Their dominance is underpinned by facilitating access to 100% of the 50 lounges currently operational in India, and they also enjoyed a market share of over 95% of all India issued credit card and debit card (Card Based) access to airport lounges in Fiscal 2020.

- Further, as at December 31, 2021 through some partnerships with other service providers, they have a global footprint extending to 1,259 Touch-points in 121 countries across the world including India.

Business operations

- They provide Clients the option of providing the Consumers different mechanisms to access certain airport related services like lounges via the more traditional mechanisms like credit cards or debit cards, membership cards, or via digital solutions such as mobile applications using their hybrid technology.

- their revenues are primarily based on and are driven by the number of unique times Consumers avail the Services.

Services offered:

- Lounge Access: They have 100% coverage of operational lounges in India, As at December 31, 2021, They had exclusivity to provide access to 11 domestic lounges constituting around 22% domestic lounges for India issued credit cards and debit cards.

- Food and Beverage offerings: They have a tie-up with 69 restaurants and F&B outlets across India as of Dec 2021.

- Spa Services: Consumers can avail of specified massage therapies such as head, neck and shoulder massage, and foot reflexology. They facilitate access to this service in tie-up with O2 Spa Salon Private Limited.

- Meet and Assist: They facilitate end-to-end assistance to the Consumers at the airport. The services are available at select airports to Consumers at arrival and departure terminals of select airports in India. They have also entered into an agreement with an international airport concierge service provider facilitating the ‘meet and assist’ services at various airports across countries such as Australia, Austria, Canada, Belgium, Brazil, France, Germany, United Kingdom, United Arab Emirates and United States of America. The following services form part of the ‘meet and assist’ service offering:-

- On departure: Receiving Consumers, assisting with baggage, assisting in check-in, immigration (where permissible) security check and, where personnel are permitted to accompany passengers beyond the security check point, assisting in obtaining lounge access, and escorting Consumers upto the boarding gate; and

- On arrival: Receiving Consumers at the aero-bridge, assisting in immigration clearance (where permissible), baggage assistance, and escorting Consumers to their transport.

- Airport transfer services: They facilitated airport transfer, i.e., airport ‘pick-up and drop’ facilities in 47 cities across India and in 145 cities outside India, as at December 31, 2021.

- Transit Hotels / Nap Room Access: In Mumbai and New Delhi, through their tie up with Niranta Airport Transit Hotel & Lounge (a unit of International Airport Hotels & Resorts Private Limited) and Holiday Inn Express New Delhi International Airport T-3 (a unit of Devaryaa Hospitalities Private Limited), they facilitate access to hotel rooms. Further, in Bengaluru, Cochin and Mumbai, they also facilitate access to ‘nap rooms’ or ‘sleeping pods’, i.e., specialised facilities which allow passengers, particularly transit passengers, access to private rooms / compartmentalised sleeping quarters, with rest-room access.

- Baggage Transfer: They have tied up with a service provider to provide baggage pick-up and drop-off facility to and from airports across Bengaluru, Hyderabad, Mumbai, and New Delhi.

- Other: In addition to providing Services at airports, They have also, in the current Fiscal, forayed into the railways sector and, they have entered into contracts to provide lounge access at 5 railway stations in India.

STRENGTHS

- Dominant player in the airport lounge aggregation industry in India with strong tailwinds

- Entrenched relationships with marquee Clients including global card network providers in India and prominent Indian and global banks and corporates

- Strong business moat due to flywheel effect led by Clients and Operators network

- Ability to capitalize on growing Consumer base with no associated costs of direct Consumer acquisition.

- Asset and human resource light business model with a strong track record of delivering consistent growth

- Proprietary technology platform that ensures scalability

- Experienced promoters and management team with strong domain expertise

- They provide services to all debit/credit card holders like Visa, Mastercard, Diners/Discover and RuPay, and many of India’s prominent Card Issuers including ICICI Bank Limited, Axis Bank Limited, Kotak Mahindra Bank Limited, HDFC Bank Limited (in respect of debit card lounge program) and SBI Cards and Payment Services Limited.

STRATEGIES

- Increase wallet share with existing Clients

- Continue to maintain our 100% coverage of airport lounges by expanding our coverage across new airport lounges in India

- Expanding into newer sectors to create customer engagement and provide loyalty management solutions

- Continued focus to expanding our client base in current sectors

- Capitalize on our dominance in the airport lounge access market and target new high growth markets globally

- Continue to invest and leverage our technological platform and ability to offer bespoke solutions and deep integration as a differentiator

- In addition to the Consumers of our Card Issuers who can access the lounge services, they have also entered into contractual arrangements to provide Services to Consumers of sector leading Corporate Clients such as Interglobe Aviation Limited, Go Airlines Limited, Air Asia (India) Limited, Vodafone Idea Limited, Jet Privilege Private Limited, Hettich India Private Limited, Easy Trip Planners Limited and Mahindra Holidays and Resorts India Limited. For instance, subscribers of Vodafone Idea Limited who have availed of a specified plan are entitled to access to an agreed list of lounges, annually, free of charge.

Revenue Model

- They generate a significant share of revenue on per Pax basis which is recognised through the swipe or tap of credit / debit card by the Consumer on their platform. Under this arrangement, they charge a specified fee from the Client for each instance of use of Services by the Consumers i.e., they charge a pre-determined amount on a Consumer availing the Service.

- In addition, they also levy annual membership fees, integration cost, platform fee etc. They raise invoices on their Clients on a monthly basis.

INFORMATION TECHNOLOGY SYSTEMS

- The DreamFolks platform is proprietary and has been developed in-house. The entire platform technology is cloud based and allows lounges and other operators to check the Consumers’ benefits on their cards, memberships or vouchers, and allow access to facilities, based on benefits or integration as per Clients processes and systems.

- The DreamFolks platform comprises the following components: benefits configuration, benefits calculation / management engine, data exchange APIs and integration options.

- DreamFolks has developed its service dissemination channels with 24*7 customer service support, thus becoming the only Airport Service Provider covering the entire journey of an airport traveller with a plethora of independent service dissemination channels.

FINANCIALS

- Asset & Liabilities for FY22

- A growth of around 25-30% is expected in topline for coming few years, atleast till 2025-26

- Margin may show some compression going forward due to operational inefficiency and cost due to business expansion in new areas and new countries, also it is foraying its business in Railways Lounge business.

- Risk:-

- Dreamfolks is heavily dependent on Debit/Credit card issuing companies. Out of an estimated 7.5 million passengers using lounges in India more than 80% passengers use credit cards or debit cards to access domestic lounges

- Its Business is highly concentrated in a Low air travel country, India although it is growing very fast and company is exploring opportunities for biz on airports in other countries too.

- The company is new in a relatively volatile sector, Air travel and still it has not completely recovered from Covid-19, company may show volatility in revenue, margins, and profits.

.

Very well written, but this was more focused towards the growth of aviation sector and how its poised to increase in the upcoming years. Dreamfolks plan doesn't seem to be ready for these, with 50 lounges now they are not aggressively planning to lounge capacity or or locations, it will take 2025 to be somewhere around 100 and they also doesn't seem to be increasing its bottom line for a while. Also the company doesn't seem to have many affiliations with Cc/Dc with banks.

ReplyDeleteOverall being the sole player they dominate the this industry, if the management does it's thing right, they might achieve significant growth and profitability. I hope they do.

You summarised it very well. Let me know your thoughts on the company.

Thanks for putting your views. I agree with you that for them it is tough to achieve that scalability, but topline and bottomline will grow as Aviation sector is expected to grow by 39% but on a conservative side let's take it as around 30%, so Revenue per lounge will also grow by almost same pace or probably more as income of middle class grow. On a positive side I am also expecting Dreamfolks to grow topline by around 30% as it is biggest lounge aggregator in India, but bottomline may be volataile and may be margins too. Talking about expansion abroad then there are already big players operating in China, Europe, US so in those area its growth may be slow. Also it is starting biz in Railways Lounge aggregator too, we have to wait for some time if managemant walks the talk or not, how things plays out, and then may be take a call on investment. I see it as overvalued as of now, let it cool lil bit, let it show its potential for few Qtrs, and then we will decide but it is an emerging segment in Aviation setor, keep a watch for sure.

ReplyDelete